Credit assessment can be difficult when data is collected from various sources and must be evaluated accurately and consistently. Manual processes can slow down approvals and increase the possibility of errors. Today's institutions require a better, more automated way to analyze and make confident decisions.

Our solution integrates seamlessly with the Bank Statement Analyzer (BSA) and Credit Decisions Engine (CDE), providing financial institutions with a more efficient method to streamline data operations and reliable credit evaluations.

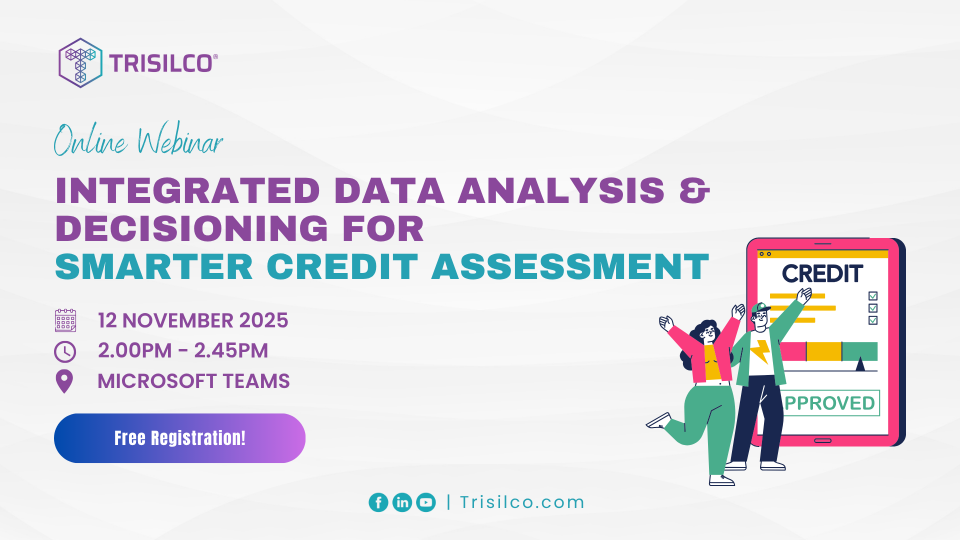

Join us in this 45-minute session to explore how automation and intelligent workflows are transforming the credit decisioning process.

📅Date: 12 November 2025

⏰Time: 2:00PM – 2:45PM (MYT)

📍Platform: Microsoft Teams

✅Reserve your spot now – it’s free!

Key Takeaways:

✔️Gain a clear understanding of how Syndesis, BSA, and CDE work together in one automated workflow to streamline Central Bank submissions, minimize manual work, and speed up turnaround times.

✔️Understand the role of Bank Statement Analyzer (BSA) in analyzing bank statements before decision rules are applied, ensuring a stronger data foundation for credit evaluation.

✔️Explore how the CDE delivers consistent and transparent outcomes by applying rules and policies on clean, verified, and consolidated data.

✔️Recognize the importance of data extraction and integration from multiple sources (CCRIS, BSA, CRAs) in building an effective credit decisioning process.

✔️Explore a flexible solution built for banks, NBFIs, and SMEs seeking faster, compliance-ready credit assessments.